There’s no question every corner of the produce industry has experienced significant change in the last decade, and we believe it’s important to chat with experts who can explain what’s happening in their marketplaces.

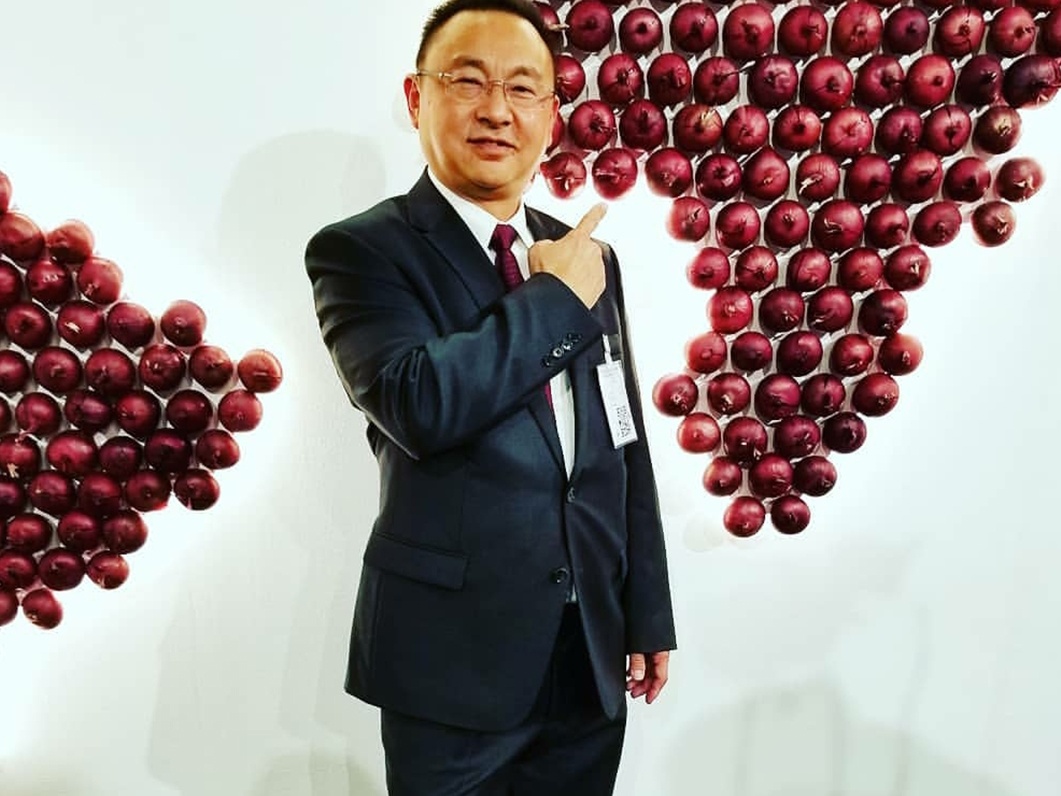

We reached out to Peter Ng in export sales for Peri & Sons Farms headquartered in Yerington, NV, recently, and he shared some very interesting insight regarding that segment of the onion industry, starting with what the overall onion export climate is like at this time.

“As of right now, export season is over for Peri and Sons as the quality has been a challenge at this stage plus we have very strong demand for our onions here in the domestic markets,” Peter said. He added that all of Peri & Sons’ onions are kept in a climate control environment, but he said, “Many in our industry store them in ambient storage, and it’s not a good idea in my opinion to export ambient storage onions as [the season] is getting late.”

Peter continued, “Very delicate handling has to be involved to ensure good arrivals for export right now. Some onions from ambient storage are starting to see internal germination and internal defects, and the chance of White Root regrowth at base plate of onions is very high by the time they arrive at final destination overseas.”

Noting it’s his opinion that the top onion export markets for the United States are Mexico and Canada, Peter went on to say, “Two of our main export customers in Asia, Taiwan and Japan, have cut down their imports drastically due to their own domestic production and cheaper supply sources, primarily China and South Korea.” And he ranked the top five export markets in order: Mexico, Canada, Latin America, Taiwan and Japan.

With the changes in technology and the expansion of a global marketplace, consumer demand in the world’s onion industry has also evolved. Peter said that over the last five to 10 years, offshore demand has changed with consumers becoming “more price-driven these days, wanting more for less.” He emphasized, “One thing to note is import requirements for many countries have changed as most [buyers and consumers] have gotten smarter. The one that has impacted us the most is Taiwan testing for cadmium presence in onions, and there is no tolerance at all.”

Moreover, he said, “Latin America is getting tougher these days as they are very strict on mold and sprouting. Some countries are even not allowing products that are more than 120 days old from harvesting!” And, Peter said, “I do see a growing demand on organic onions for international markets.”

We asked Peter how recent trade negotiations have affected export markets, and he said that at Peri & Sons, “our international clients are very niche. We are somewhat different from others, and our demand is always there as long as we can cope with it.”

That said, he commented on the broader U.S. onion export industry, saying, “Export business will just get tougher as we are facing challenges from rest of the world. In my opinion, our export handling is one of the most expensive that exists. To give you a comparison, one of the world’s most competitive onions exporting country, Holland, pays about $350-$375 U.S. to truck a 40-foot reefer of onions to the port. Here, we have to pay a minimum of about $1,000 for a container of reefer onions trucking to the ports, plus lots of extra port charges, especially in California.

“On top of that, we have very strict weight limitation on what we can load inside the 40-foot reefer containers. These constraints do not help at all!”

We asked Peter about Sunions, the tearless onion distributed by Peri & Sons and a few select other shippers in the United States. Specifically, we wanted to know if Sunions are seeing export interest.

“We have not exported any Sunions yet, although we are getting strong inquiries, mainly from Europe,” he said. He said that product “will only be sold directly to key retailers/supermarkets even in the overseas market, and we have to scrutinize the inquiries before we can proceed.”